death spiral convertible

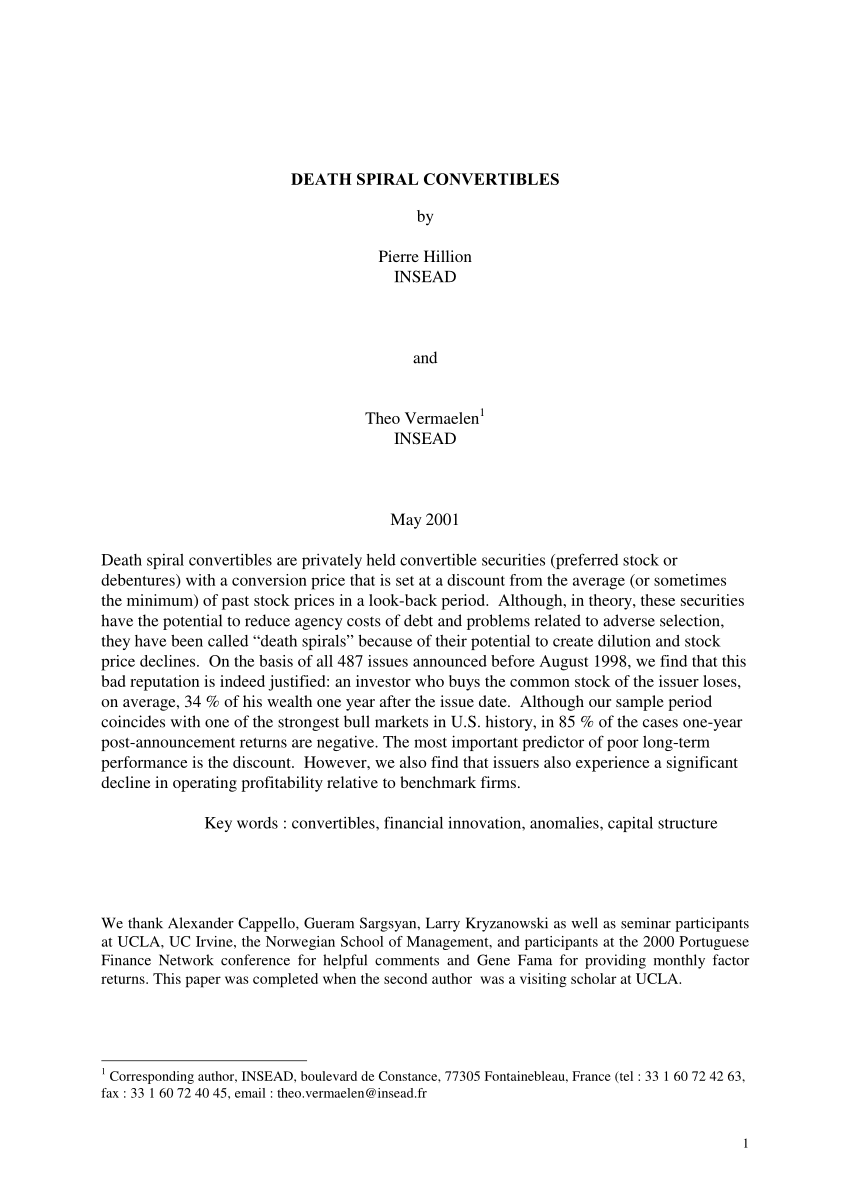

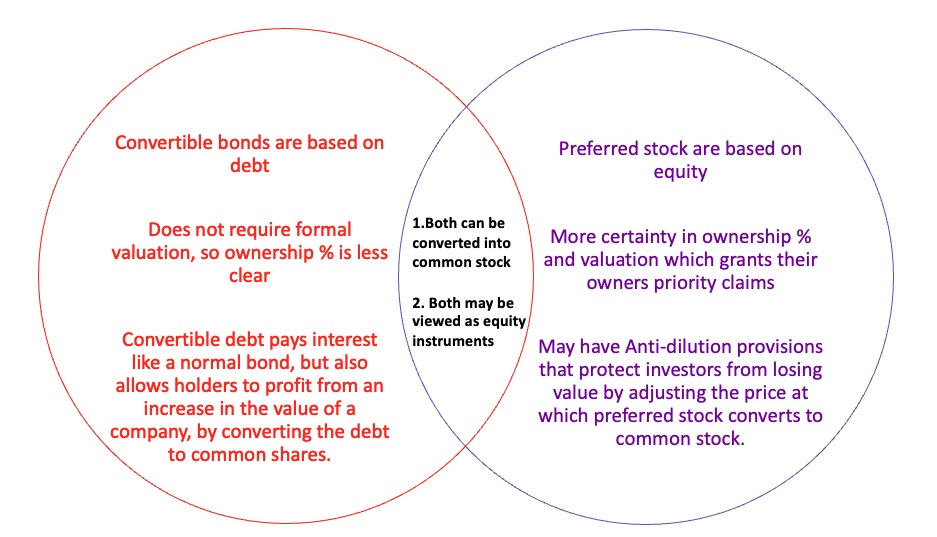

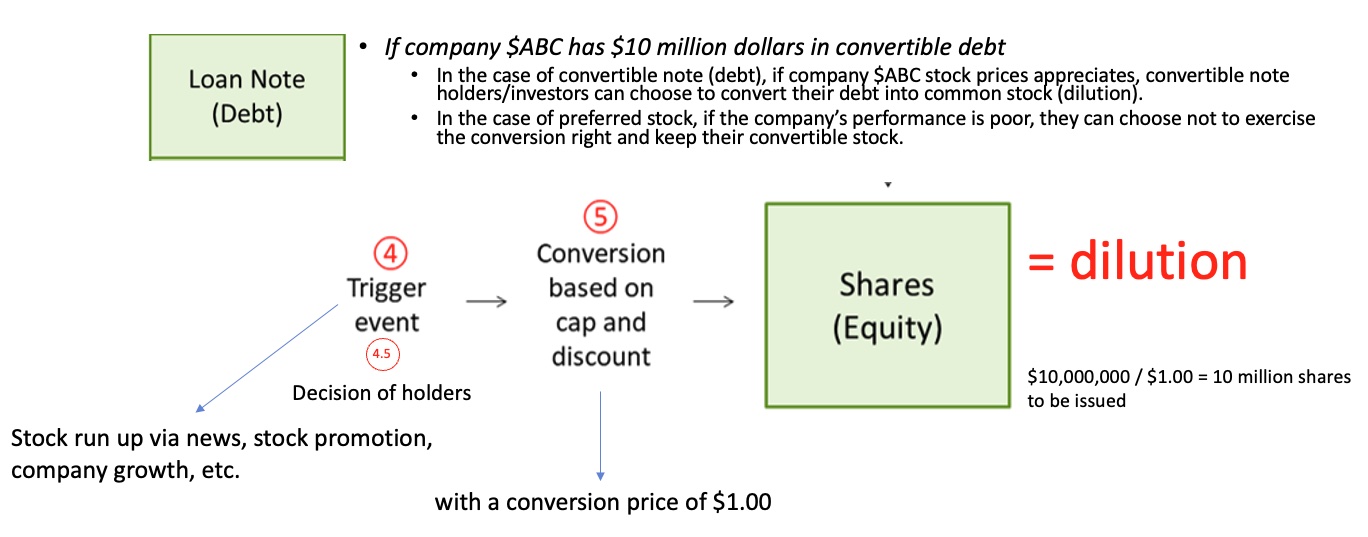

Some small companies rely on selling convertible debt to large private investors see private investment in public equity to fund their operations and growth. A death spiral convertible security is similar to a normal convertible security with one key difference.

Death Spiral Convertible Bonds Semantic Scholar

This bond converts into the common shares of an.

. In this case I. Focus on death spiral convertibles which are essentially convertibles without a fixed conversion price sharpened recently after a bondholder triggered unusual volume. Death spiral financing is a movement where convertible financing is practiced to fund small cap companies.

The US Treasury as a death-spiral convertible bond. Focus on death spiral convertibles which are essentially convertibles without a fixed conversion price sharpened recently after a bondholder triggered unusual volume. Find out more about death spiral convertible bonds in.

This convertible debt often con. Convertible notes unfairly maligned help. Finnerty Professor of Finance Fordham University March 2005 John.

This instrument is similar to a convertible bond but convertible at a. SHORT SELLING DEATH SPIRAL CONVERTIBLES AND THE PROFITABILITY OF STOCK MANIPULATION John D. PIPEs are a way for finns to raise capital by.

This differs from traditional convertibles because. Death spiral debt describes a type of convertible bond that forces the creation of an ever-increasing number of shares inevitably leading to a steep drop in the price of shares. Death spiral convertibles are privately held convertible securities preferred stock or debentures with a conversion price that is set at a discount from the average or sometimes.

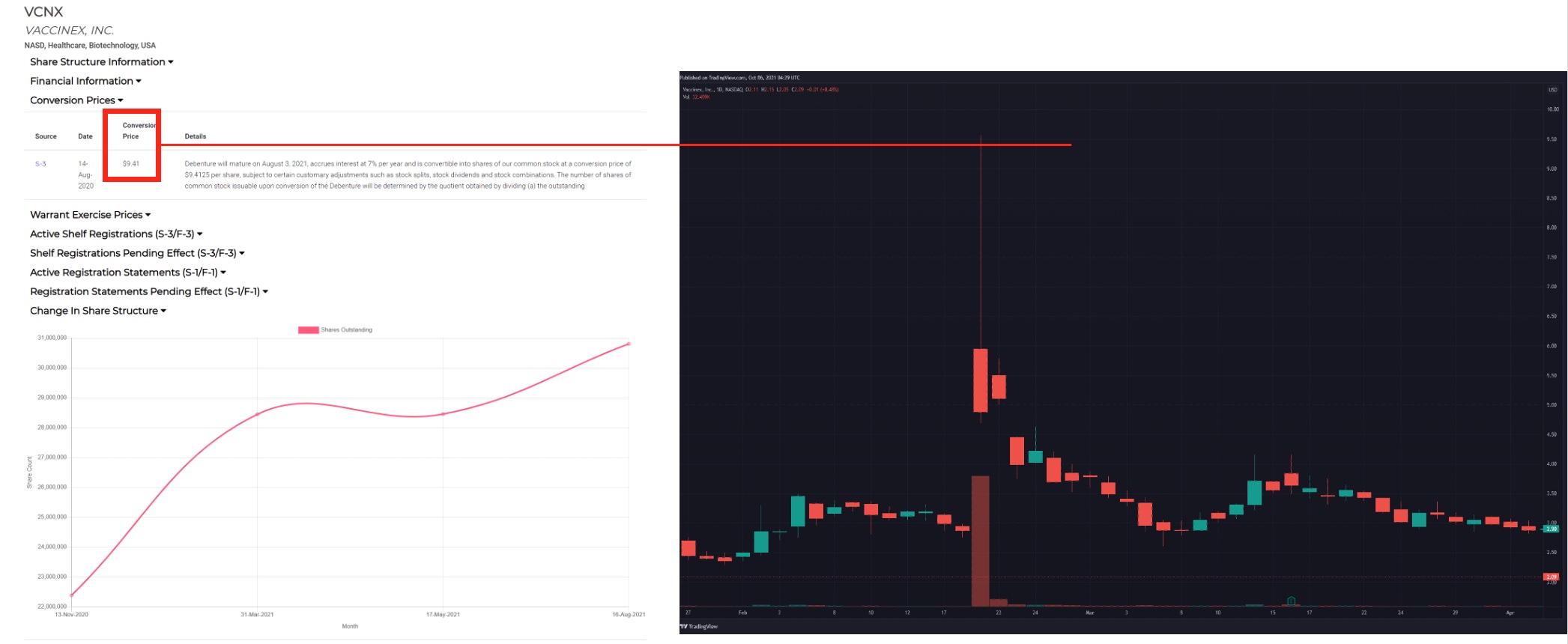

Normal convertible arbitrage is practiced with bonds with fixed conversion. Death spiral convertibles are privately held convertible securities preferred stock or debentures with a conversion price that is set at a discount from the average or sometimes the minimum of. Death spiral convertibles or floating price convertible bonds FPCs are structured private investment in public equity PIPE deals.

Founder and Managing Director. Floating-priced convertibles known as death spirals are privately held convertible securities with a conversion price set at a discount from the average of past stock prices in a. Death spiral is a term applied to a type of convertible debt that stimulates an ever-increasing number of shares leading to steep stock price drops.

In these settlements the death spiral securities were exchanged for normal convertible securities valued at either 450 or 125share or cash depending on the company. One bad sign is a death spiral convertible one that converts into a fixed value rather than a fixed number of shares. Floating-priced convertibles known as death spirals are privately held convertible securities with a conversion price set at a discount from the average of past stock prices in a.

Floating-priced convertibles known as death spirals are privately held convertible securities with a conversion price set at a discount from the average of past stock prices in a. Used by companies that are in such bad shape that there is no other way to get financing. This can then be used against it in the marketplace causing the stocks value to.

A Death Spiral Convertible Bond is a convertible bond in which the conversion price is not predetermined but is kept floating. Used by companies that are in such bad shape that there is no other way to get financing. Death spiral convertibles are privately held convertible securities preferred stock or debentures with a conversion price that is set at a discount from the average or sometimes the minimum.

Death spiral convertibles are a type of loan lenders give to a firm in exchange for a right to convert into equity at below market prices. Tan Choon Wee. Death spiral financing is the result of a badly structured convertible financing used to fund primarily small cap companies in the marketplace causing the companys stock to fall dramatically which can lead to the companys ultimate downfall.

Indeed the NIR Group which mainly invests in death spiral PIPEs reports. Instead of getting X number of shares I get X dollars paid in shares. Foreigners dont want US Treasuries but pile into a stock market that keeps rising as Fed pushes down bond yields.

The convertible bond unlike a. A convertible reset PIPE is a modified death spiral that doesnt have an endless conversion feature. This instrument is similar to a convertible bond but convertible at a.

In a famous case in 2003 Thomas Newkirk then the Associate Director of the SECs Division of Enforcement stated the following in relation to toxicity of death spiral finance.

Barbie 57 Chevy Pink Convertible Car New Ebay Barbie Car Pink Convertible Barbie

Death Spiral Convertible Bonds Semantic Scholar

Nora Nora A Novel By Anne Rivers Siddons 2000 Hc Good Etsy In 2020 Novels Anne Bruce Boxleitner

What Is Death Spiral Financing What Does Death Spiral Financing Mean Youtube

The Us Treasury As A Death Spiral Convertible Bond Asia Times

The Us Treasury As A Death Spiral Convertible Bond Asia Times

Otc Markets Death Spiral Funders Days May Be Numbered

Average Quarterly Stockholder Wealth Effects Of Convertible Seasoned Download Scientific Diagram

Newly Deceased Stablecoin Ust And Others Like It Are Death Spiral Convertible Bonds In Disguise Whoever Crashed Ust And Luna Is Selling Death Spirals Directly To Retail R Superstonk

Comments

Post a Comment